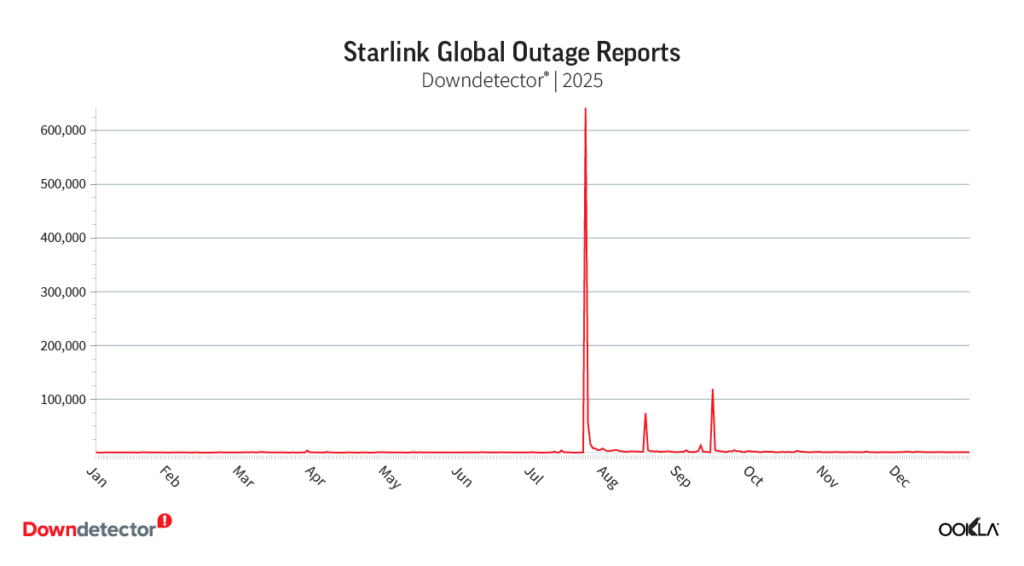

According to the Ookla 2025 Global Satellite Broadband Performance Report released on February 5, 2026, SpaceX’s Starlink achieved a staggering level of market dominance, accounting for 97.1% of all global satellite Speedtest samples in the third quarter of 2025.

This metric serves as a powerful proxy for Starlink’s massive user base and active network usage compared to its competitors.

1. The Competitive Gap

The data highlights a near-total displacement of traditional Geostationary (GEO) satellite providers in the consumer market.

| Provider | Global Speedtest Sample Share (Q3 2025) | Estimated Global Subscribers |

| Starlink | 97.1% | ~9.2 Million |

| Viasat | 1.7% | ~157,000 (US) |

| HughesNet | 1.0% | ~783,000 |

| Others | 0.2% | N/A |

- Growth Trajectory: Starlink added over 4.6 million new active customers in 2025 alone, doubling its capacity to nearly 600 Tbps.

- The “Referral” Shift: In a surprising industry turn, rival HughesNet (owned by EchoStar) has reportedly begun referring some of its own customers to Starlink following a deal to sell radio spectrum to SpaceX.

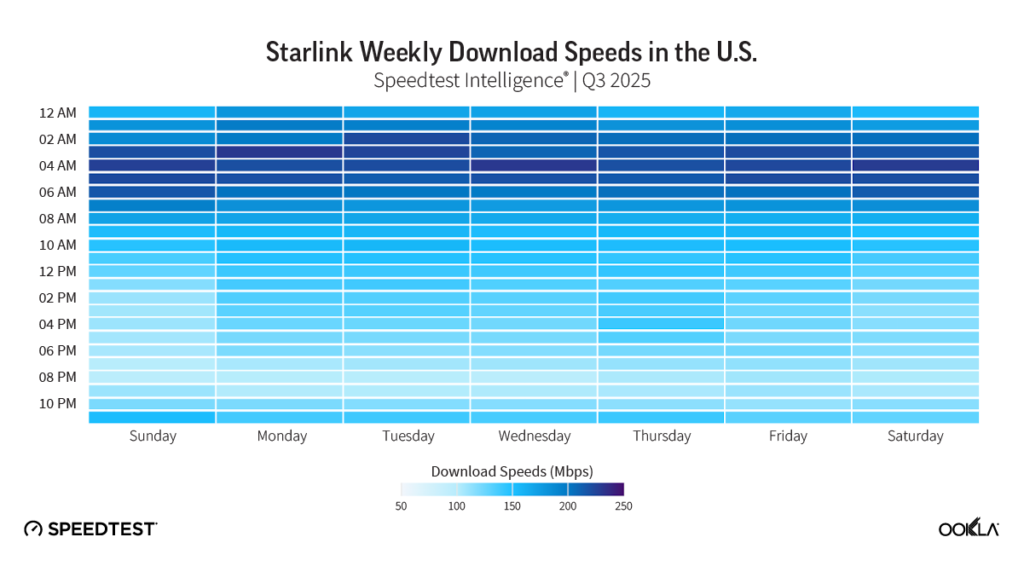

2. Performance Benchmarks (Q3 2025)

Starlink’s dominance isn’t just in volume; its Low Earth Orbit (LEO) constellation continues to significantly outperform traditional satellites in both speed and latency.

- Top Speed Markets:

- Latvia: 187.30 Mbps (Global Leader)

- Northern Mariana Islands: 186.15 Mbps

- New Zealand: 185.37 Mbps

- United States: 117.74 Mbps (Median)

- Latency Breakthrough: Starlink reached a median peak-hour latency of 25.7 ms in the U.S. even its highest global latency (282 ms in the Marshall Islands) was less than half that of the fastest GEO satellite measurements.

3. Geographic Distribution of Users

Based on the origin of the speed test samples, Starlink’s top five markets represent a diverse global footprint:

- United States: 22.5% of all samples.

- Mexico: Driven by high adoption despite some congestion (54 Mbps median).

- Brazil: Recently surpassed 1 million active users, making it the second-largest market.

- Indonesia: A key growth hub for 2025.

- Canada: Surpassed 500,000 users with a median download speed of 111.34 Mbps.

4. 2026 Outlook: The “Starship” Factor

The report notes that Starlink is moving into its “Third Generation” (V3) phase:

- Launch Cadence: SpaceX completed 165 orbital flights in 2025 (85% of the U.S. total).

- Starlink V3: Starting in the first half of 2026, Starlink will begin launching V3 satellites via Starship. Each launch is projected to add 60 Tbps of capacity—a 20x increase over current second-generation launches.

- Direct-to-Cell: As of early 2026, Starlink’s 4G coverage serves 12 million people across 22 countries using unmodified cell phones.

Conclusion: Infrastructure as a Moat

Starlink’s 97.1% share of global tests suggests that for the average consumer, “satellite internet” has become synonymous with “Starlink.” While Amazon’s Project Kuiper is expected to begin commercial scaling later in 2026, Starlink’s massive head start in launch frequency and manufacturing (70 satellites per week) has created a moat that competitors are finding increasingly difficult to bridge.