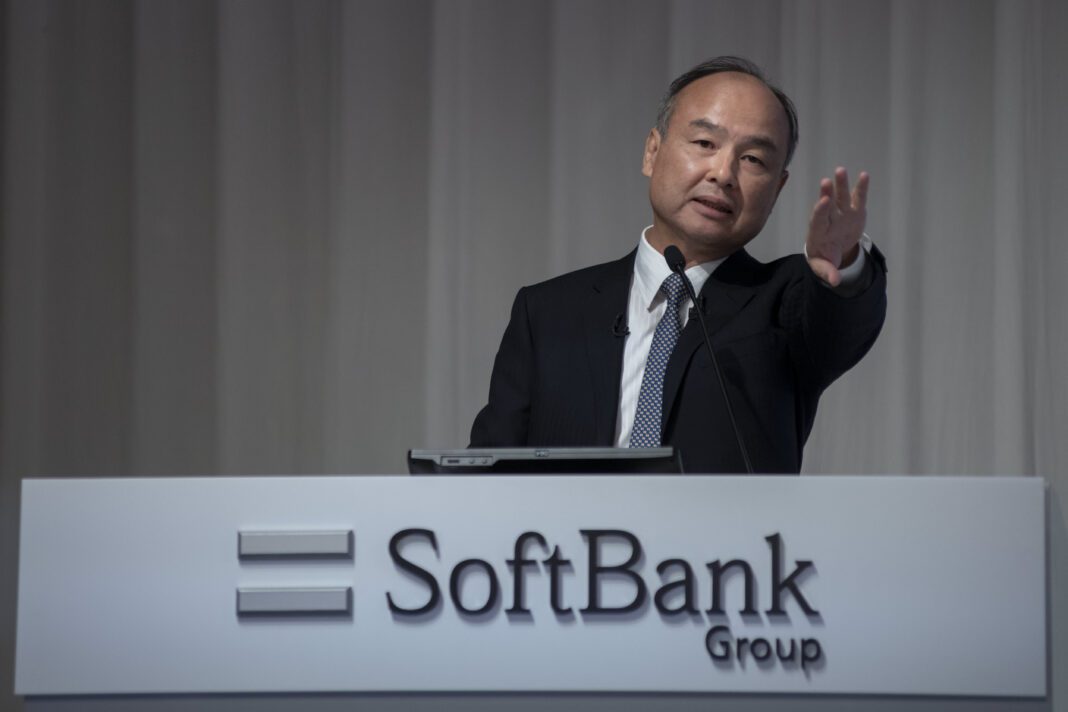

Japanese conglomerate SoftBank Group reported a net profit of ¥2.5 trillion (≈ US$16.6 billion) for the quarter ended September 30 2025, more than double the ¥1.18 trillion reported a year earlier. Analysts had expected a far smaller profit (~¥207 billion) for the period, making the result a clear beat.

What Drove the Surge

- The major driver was valuation gains in its investment portfolio — particularly from its stake in OpenAI. SoftBank’s “Vision Funds” reported an investment gain of ¥3.5 trillion, of which about ¥2.16 trillion came from OpenAI.

- The timing coincides with a broader run-up in AI technology, and SoftBank taking advantage of its holdings in leading AI/hardware companies.

- SoftBank also sold its entire stake in Nvidia Corporation for US$5.83 billion in October — the proceeds are part of the broader reallocation toward AI infrastructure. Financial Times

Why It Matters

- Such a large profit jump signals that SoftBank’s strategy of placing big bets on AI infrastructure and future technologies is paying off — for now.

- This result strengthens SoftBank’s financial flexibility: it can raise and deploy capital more aggressively, potentially accelerating its investments across its “cluster of No.-1” strategy (AI, chips, data-centres, robotics).

- For investors, the profit sets a high benchmark but also raises questions: can such gains be sustained when they depend heavily on fair-value changes and large portfolio movements rather than core operating business growth?

Risks and Considerations

- Much of the profit comes from unrealised gains—valuations on paper rather than cash-realised returns. These can reverse if underlying assets underperform.

- SoftBank’s portfolio remains exposed to high-growth/high-risk segments (AI, infrastructure, chips) which may face execution risks, regulatory headwinds or over-valuation concerns.

- The market is increasingly cautious about a potential “AI bubble”, and SoftBank’s big bets could attract scrutiny or pressure if results don’t continue to deliver.

Outlook: What to Watch

- How SoftBank redeploys this capital: Where will the next major investments go? Chips, data centres, robotics or something else?

- Whether more stakes are sold (like Nvidia) to fund larger strategic commitments — and the timing and impact of those moves.

- Whether operating profits (versus investment/valuation gains) grow sustainably over the coming quarters.

- Whether SoftBank’s NAV (net asset value) and debt/leveraging metrics remain healthy as it pursues ambitious growth.

Final Word

SoftBank’s Q2 result — a US$16.6 billion profit — is impressive and underscores the power of its investment model when things go right. However, the heavy reliance on portfolio gains and the large bets on AI/infrastructure mean that sustainability and execution will be key to validating this as a turning point rather than a one-off spike.