Global technology investor SoftBank Group is reportedly in advanced talks to invest in Indian cloud infrastructure startup Neysa Networks — strengthening its footprint in India’s booming cloud-business segment.

The term “India cloud startup Neysa” will guide this article, as we unpack the significance of the move.

What’s Happening

SoftBank is partnering (in negotiation) with global asset manager Blackstone Inc. to acquire a stake in Neysa. According to reports:

- Blackstone is exploring a majority stake.

- SoftBank is expected to take a smaller/minority share — but importantly: it would mark SoftBank’s first major new investment in India in over three years.

- The valuation for Neysa is being floated at under US $300 million.

If completed, it would signal a strong belief in India’s growing demand for cloud infrastructure and AI-enabled compute services.

Why It Matters for India Cloud Startup Neysa

1. Growing demand for cloud and AI compute

India’s enterprises and public sector are rapidly adopting AI models, requiring high-performance compute and cloud infrastructure. Neysa is positioned to serve this niche. Angel One+1

2. Neysa’s specialised offering

Founded in 2023 by industry veterans (Sharad Sanghi and Anindya Das), Neysa focuses on cloud/AI-infrastructure rather than generic hosting. This specialisation gives it credibility.

3. Global investor confidence

SoftBank’s interest suggests international investors are increasingly confident in Indian tech infrastructure. For Neysa, this could open doors to further capital, partnerships and global clients.

4. Timing advantage

The window to become a leading “Made in India” cloud/AI infrastructure player is open. With large incumbents still scaling and new regulations favouring domestic infrastructure, Neysa can gain first-mover advantage.

5. Strategic India expansion for SoftBank

SoftBank is seeking to re-enter India’s tech investment ecosystem. Partnering with Neysa allows it to tap into infrastructure (rather than consumer apps) — a strong long-term bet.

Background: The Players

Neysa Networks – An Indian startup founded in 2023, focused on cloud infrastructure for AI workloads. Earlier funding rounds reportedly raised around US $50 million from investors such as Z47 (formerly Matrix Partners India), Nexus Venture Partners.

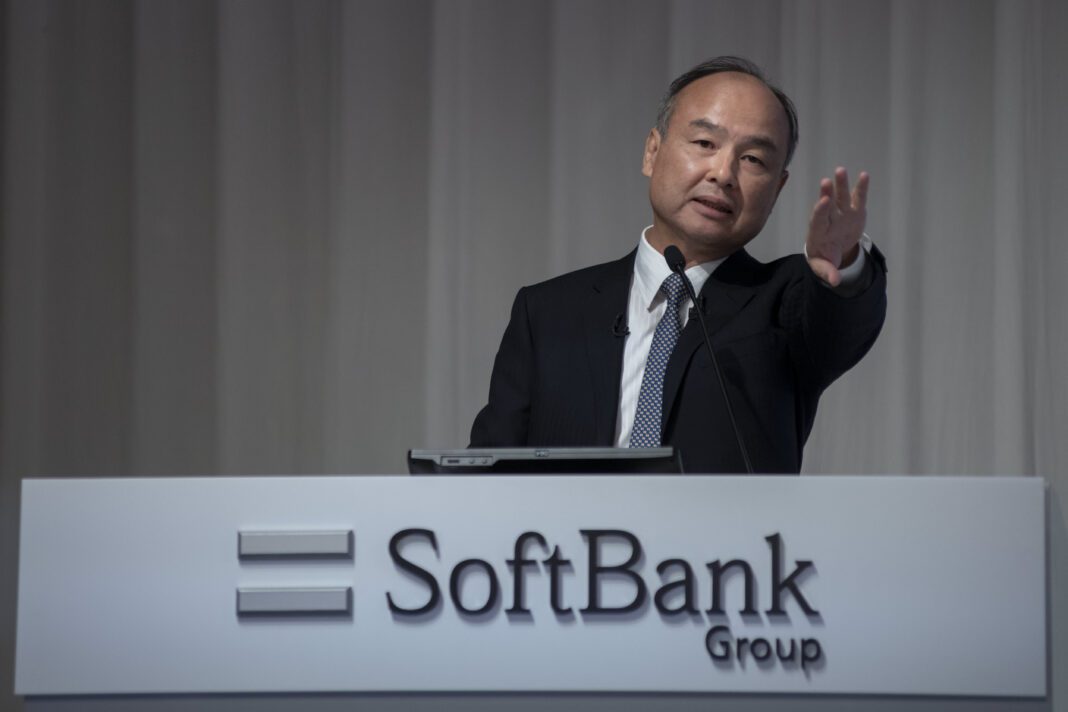

SoftBank Group – A Japanese multinational holding company known for its Vision Fund and large bets in tech globally. Its move into India’s infrastructure layer signals a strategic shift.

Blackstone Inc. – A large US-based asset manager, increasingly active in India’s digital and physical infrastructure. Their interest in Neysa fits a broader trend of infrastructure investment in India.

Potential Outcomes & Impacts

- For Neysa: With new capital, the company can scale its data-centres, expand GPU/AI-cloud services, and possibly go after large enterprise or government contracts.

- For SoftBank & Blackstone: A stake in an infrastructure platform provides exposure to secular growth in cloud/AI — in one of the world’s fastest-growing markets.

- For the Indian market: This deal could spur more investment into local cloud/AI infrastructure startups, boosting competition and innovation.

- Risk factors: The deal is still in talks — valuations may shift; regulatory or infrastructure hurdles may delay rollout; competition from global giants remains strong.

What to Watch Next

- Final deal terms (valuation, stake size, investor rights)

- Neysa’s roadmap: Which geographies, services, industries will they target?

- How SoftBank manages its India-strategy via this investment

- Impact on pricing and competition in India’s cloud/AI-infrastructure sector

Conclusion

The potential deal involving SoftBank and Neysa underscores a turning point for Indian tech: moving beyond apps and services into the infrastructure backbone of AI. For “India cloud startup Neysa”, this could be the launchpad towards becoming a major player — with global backing, local advantage, and market tailwinds aligned.