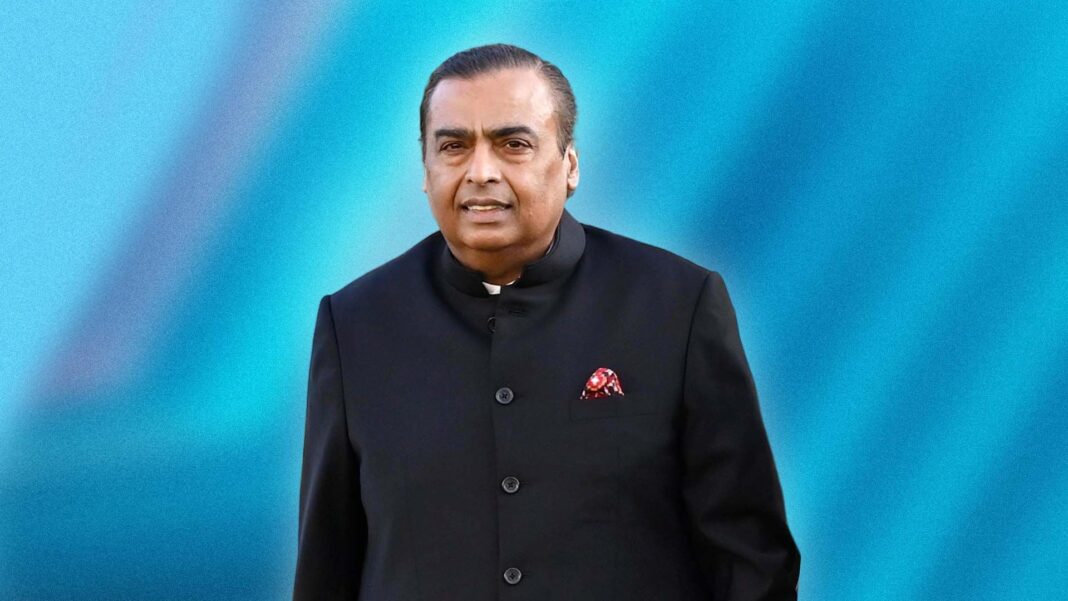

Billionaire Mukesh Ambani-led Reliance Industries is planning to raise approximately ₹180 billion (around $2.06 billion) through an asset-backed securities (ABS) transaction, according to Bloomberg News. The deal is one of the largest securitisation moves in India this year

Deal Structure & Details

The securities will be issued via a trust, supported by a pool of loans against Reliance’s infrastructure and telecom divisions. They will carry a maturity of three to five years. International bank Barclays Plc is orchestrating the transaction, which is expected to be finalized by mid-September 2025.Reuters

Strategic Significance in Financing Strategy

- The ABS deal provides Reliance with liquidity without increasing traditional debt, effectively monetizing existing loan receivables.

- Structured financing through securitisation reflects a maturing capital markets approach, offering investors structured debt exposure against quality collateral.

- With securitisation volumes in India on track to hit ₹2.5 trillion by March, this deal underscores Reliance’s leadership in financial innovation.

Summary Table

| Feature | Details |

|---|---|

| Format | Asset-Backed Securities via trust |

| Amount | ₹180 billion (~$2.06 billion) |

| Collateral | Loans from telecom & infrastructure arms |

| Maturity | 3–5 years |

| Deal Arranger | Barclays Plc |

| Expected Closure | Mid-September 2025 |

| Strategic Impact | Liquidity without new debt; ABS market boost |

What It Means for the Market

This transaction signals Reliance Industries’ ability to diversify capital-raising channels and tap structured finance, enhancing flexibility amidst geopolitical and operational headwinds. It sets a new benchmark for securitisation activity in India and supports the company’s ambitious growth and investment trajectory.