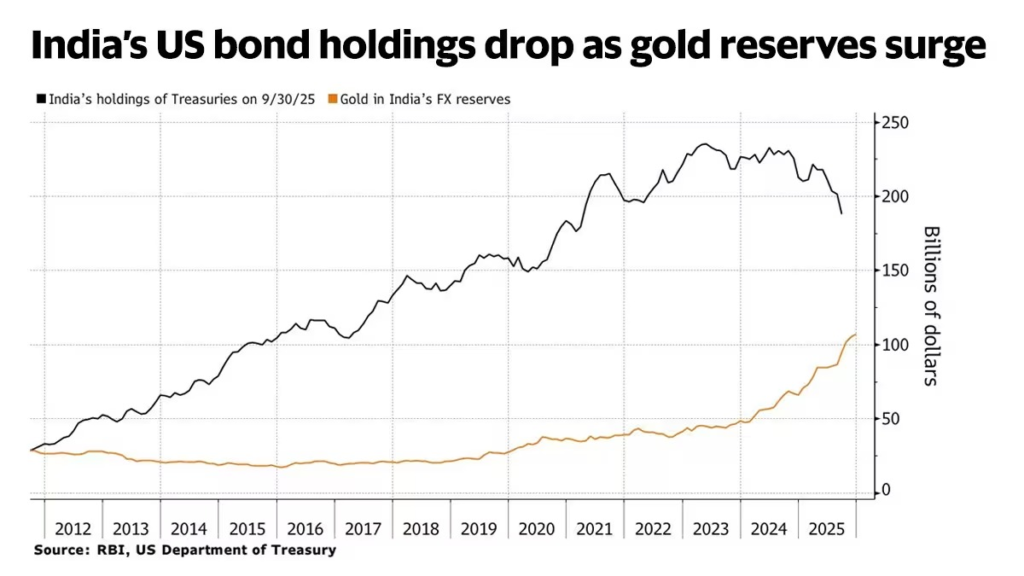

According to the latest US Treasury data and financial analyses released in January 2026, India has slashed its exposure to US government debt by approximately 21% over the last 12 months. This marks the first sustained annual decline in four years.

The Numbers at a Glance

- Holdings Drop: Reduced from $241.4 billion (Oct 2024) to $190.7 billion (Oct 2025).

- Current Level: The lowest exposure since 2020–21.

- Portfolio Shift: US Treasuries now account for approximately one-third of India’s total forex assets, down from 40% a year ago.

Why is the RBI Offloading US Bonds?

Financial experts and economists point to three primary drivers for this multi-billion dollar reallocation:

1. Defensive Rupee Management

The RBI has been actively selling liquid US Treasuries to finance interventions in the foreign exchange market. By offloading these bonds, the central bank generates the dollar liquidity needed to purchase Indian Rupees, helping to stabilize the currency which hit record lows in late 2025 following the imposition of high US tariffs on Indian exports.

2. The “Gold Rush” & Diversification

The RBI is reallocating its “reserve stack” toward assets perceived as more stable during periods of high global uncertainty.

- Gold Surge: Gold’s share in India’s reserves reached a 20-year high of 16.2% in January 2026.

- Tonnage Growth: India’s gold holdings reached an estimated 880 metric tonnes by late 2025, up significantly from previous years.

3. Sanctions Risk & De-dollarization

Following the 2022 freezing of Russia’s reserves, many central banks—including the RBI—have become wary of holding excessive dollar-denominated assets. This “considered decision” to diversify aims to mitigate sanctions risks and reduce dependence on the US financial system amidst trade friction.

India’s Reserves in the Global Context

| Country | US Treasury Trend (2026) | Strategic Direction |

| Japan | Increasing ($1.2 Trillion) | Remains the largest foreign holder. |

| China | Decreasing ($682 Billion) | Strategic long-term retreat to 16-year lows. |

| India | Decreasing ($190 Billion) | Pivot to gold and rupee support. |

| UK / Belgium | Increasing | Strengthening ties with the US bond market. |

Conclusion: A Structural Realignment

The drawdown to a five-year low is not a temporary reaction to interest rates but a structural shift in how India views its “rainy day fund.” While the US dollar remains the pre-eminent global reserve currency, the RBI is prioritizing resilience and risk distribution over bond yields. By the end of January 2026, with India’s total forex reserves standing at a healthy $701 billion, the central bank has successfully balanced its sell-off with a massive buildup in bullion, creating a more multi-polar reserve profile.