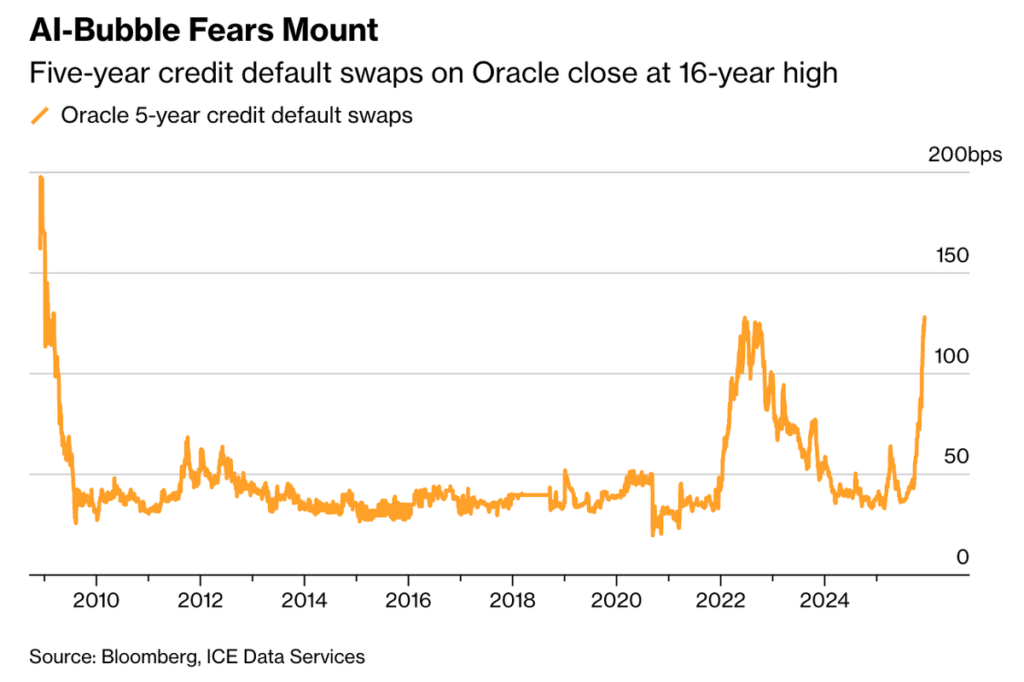

Credit markets are demanding sharply more to insure against a default by Oracle — meaning its cost of debt-insurance, via credit-default swaps (CDS), has jumped to the highest level in roughly 16 years

- This rise reflects growing concern over Oracle’s expanding debt load, fueled by massive investments in AI infrastructure and cloud data-center expansion

- As of late 2025, Oracle’s total debt had crossed over $100 billion — and new rounds of borrowing (including recent bond issues and loans) have deepened worries about long-term debt servicing.

Why Debt Insurance Costs Are Surging

🔹 Heavy AI & Cloud-Spending Push

Oracle has committed billions toward AI infrastructure — data centers, hardware, expansion programs — betting heavily on future growth. But this requires upfront capital, and much of it is financed through debt.

🔹 Weakening Cash Flow & High Leverage

Analysts note that, despite the borrowing, Oracle’s cash flow has turned negative — meaning the company is spending more than it’s earning. The Economic Times

With debt-to-equity and debt-to-EBITDA ratios rising well above norms, creditors demand higher premiums to insure that debt.

🔹 Growing Concern from Credit Markets & Rating Agencies

Major agencies have given Oracle a “negative outlook,” flagging “counterparty risk” and a steep leverage path tied to its AI-deal commitments.

As a result, traders are increasingly using CDS to hedge against the risk of default — pushing insurance costs higher.

Implications: What Debt Insurance Spike Means

- Higher borrowing cost for Oracle: As CDS spreads rise, future debt issuance and refinancing may become more expensive, squeezing margins.

- Investor caution / volatility: Rising credit risk can create volatility in both bond and equity markets — investors may demand higher yield or avoid exposure.

- Signal of broader risk in AI-capital intensive firms: Oracle’s situation becomes a bellwether for other tech firms taking on heavy debt for AI/cloud investments — the debt-insurance surge may signal systemic caution.

- Greater scrutiny from regulators and rating agencies: Persistent leverage and negative cash flow could prompt downgrades if performance doesn’t improve.

What Could Come Next for Oracle

- If Oracle can show improving cash flow — e.g., revenue from AI/cloud contracts materializing — it might calm credit markets and lower CDS spreads.

- Otherwise, persistent heavy borrowing and negative cash flow could lead to further credit-rating downgrades, higher borrowing costs, and more conservative investor sentiment.

- Watch for upcoming earnings reports, debt-servicing costs, and disclosures about how AI investments are converting to revenue — they’ll be key in shaping credit-market confidence.

Conclusion

Oracle’s debt-insurance costs hitting a 16-year high reflects deep concerns among lenders and investors about the risks tied to its aggressive AI-driven expansion. The surge signals that credit-market participants are demanding substantial compensation for shouldering that risk. For Oracle — and for other tech firms making similar leveraged bets — the coming quarters will be crucial. Whether these investments pay off or backfire could determine not just their stock and bond value, but also the broader trust in AI-financed growth strategies.