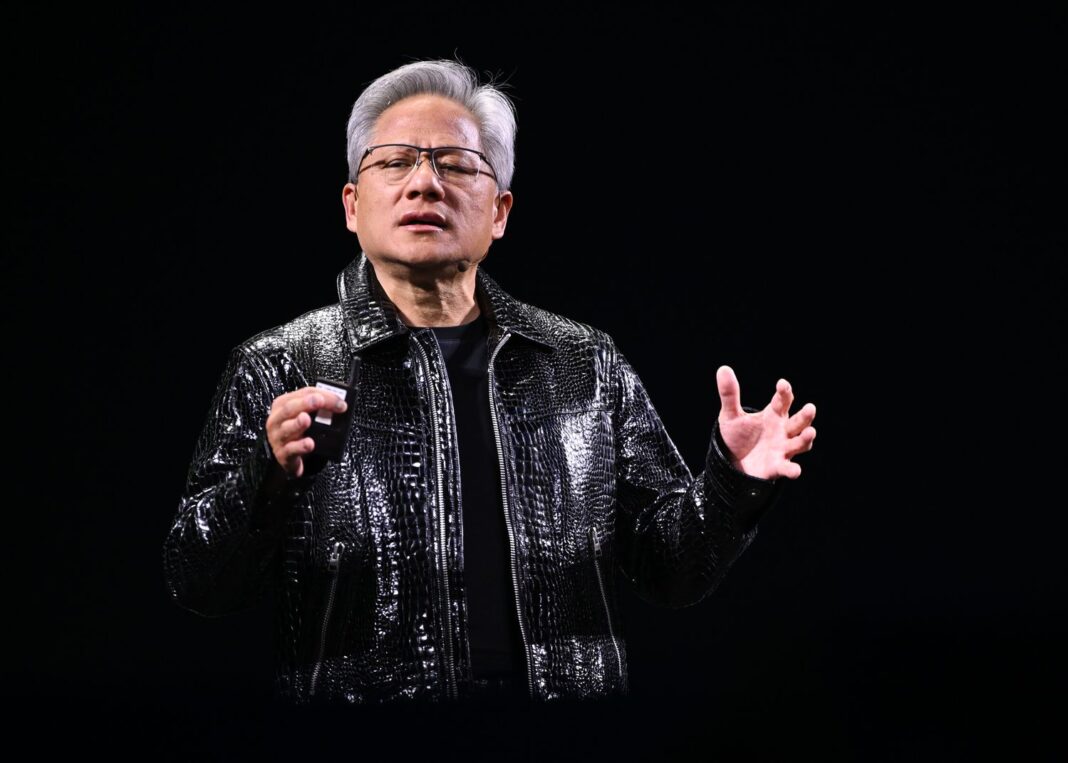

In a candid assessment of the escalating US-China tech rivalry, Nvidia CEO Jensen Huang stated that China is just “nanoseconds behind” the United States in semiconductor advancements, urging Washington to ease export restrictions to allow American firms like Nvidia to compete freely in the Chinese market. Huang made these remarks during the September 27, 2025, episode of the BG2 podcast, hosted by tech investors Brad Gerstner and Bill Gurley, emphasizing that global competition would “proliferate the technology around the world” and maximize America’s economic and geopolitical influence. As Nvidia grapples with US curbs on AI chip exports to China—its second-largest market—this perspective highlights the rapid pace of Chinese innovation, from Huawei’s foldable dominance to domestic GPU breakthroughs, amid a $500 billion global chip industry.

For investors navigating US-China tensions, tech executives eyeing supply chains, and policymakers balancing security with growth, Huang’s “nanoseconds” metaphor underscores the fleeting edge of US leadership. With Nvidia’s market cap at $3.5 trillion and China pushing self-sufficiency, the call for openness could reshape export policies. Let’s break down Huang’s comments, the chip race context, and potential ripple effects.

Huang’s Key Points: Compete Now, Before the Gap Closes

On the podcast, Huang dismissed notions of a prolonged US lead, praising China’s “vast talent pool, strong work ethic, and healthy internal competition” across provinces. He argued that barring US tech from China harms American interests, noting Beijing’s pledges to remain “open to foreign investment.” This comes amid recent US reversals: In August 2025, exports of Nvidia’s H20 chip (a restricted variant) were halted briefly before resuming with a 15% levy to the US government, following a deal with President Trump.

Huang’s optimism about China contrasts with his past frustrations: In September 2025, he expressed “disappointment” over reports of Beijing urging firms like ByteDance and Alibaba to shun Nvidia chips, calling it a blow to global supply chains. Yet, he views competition as mutual: “What’s in the best interest of China is for foreign companies to invest, compete, and for them to have vibrant competition themselves.”

The Chip Race: China’s Rapid Catch-Up and US Export Walls

Huang’s “nanoseconds” quip captures the blistering speed of semiconductor progress, where process nodes shrink annually and AI demand surges 20-30% yearly. China, once reliant on Nvidia (95% AI GPU share pre-2023), now invests $50 billion+ in domestic chips via initiatives like Made in China 2025. Key milestones:

- Huawei’s Ascend 910B: Shipping in volume, optimized for CUDA-free software stacks, matching current-gen Nvidia performance.

- Startups Thriving: Cambricon’s valuation soared, Moore Threads eyes IPO, and Enflame/MetaX attract billions—fueled by Alibaba, Tencent, and Baidu’s in-house R&D.

- Self-Sufficiency Push: Beijing’s ambivalent stance—welcoming Huang’s visits while mandating local alternatives—has cut Nvidia’s China sales by 20-30% since 2023 curbs.

US restrictions, intensified under Trump (e.g., 100% tariffs on non-compliant imports), aim to curb military risks but, per Huang, risk ceding ground: “We’ve got to go compete.” Nvidia’s H20 workaround—80% Blackwell performance—shows adaptation, but Huang warns of a “digital Cold War” where both sides lose.

Implications: Economic Wins, Geopolitical Tensions

Huang’s appeal could influence policy: With Trump’s “America First” agenda, easing curbs might boost Nvidia’s $100 billion China revenue potential, creating US jobs via exports. For China, it sustains AI growth amid self-reliance drives.

Broader effects:

- Investor Angle: Nvidia shares dipped 1% post-podcast amid tariff fears, but Huang’s optimism could lift sentiment if deals like the H20 levy expand.

- Global Supply Chains: A more open China accelerates innovation (e.g., Huawei’s foldable lead), but risks espionage claims.

- Tech Rivalry: Echoes Schmidt’s (ex-Google CEO) calls for collaboration, but tensions persist—China’s military shuns US AI, per Huang.

As Huang put it, Washington and Beijing “have larger agendas to work out”—a nod to the pawns tech CEOs play in geopolitics.

Conclusion: Huang’s ‘Nanoseconds’ Warning – Compete or Concede?

Nvidia CEO Jensen Huang’s revelation that China is “nanoseconds behind” the US in chips is a wake-up call for open markets, framing competition as a win-win amid export walls. With Huawei and startups closing fast, easing restrictions could sustain US dominance—or risk a bifurcated tech world. As the podcast stirs debate, Huang’s plea might just bridge the agendas. scmp