Eastman Kodak, the iconic photography company founded in 1892, has issued a “going concern” warning, casting doubt on its ability to continue operating. The firm recently disclosed it may lack the funds to meet nearly $500 million in debt obligations.

Key Highlights

- Financial Emergency: Kodak revealed in its earnings report that it doesn’t have “committed financing or available liquidity” to cover its short-term debt, raising serious doubts about its future

- Stock Collapse: Following the announcement, Kodak’s share prices nosedived—declining between 13% to 25%, depending on the reporting outlet.

- Cutting Costs: To conserve cash, the company has paused payments to its employee retirement pension plan.

- Pessimistic Outlook: Kodak’s CFO described the situation as creating “substantial doubt” about the company’s ability to remain operational over the next year.

** Why This Matters**

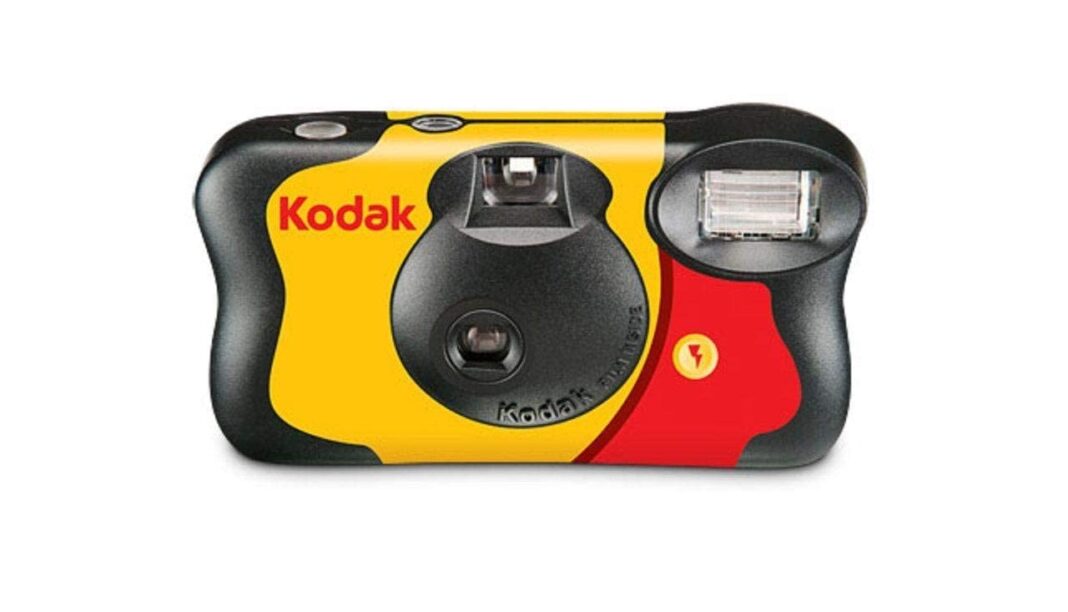

Kodak, once dominant in film photography and a pioneer of the first digital camera in 1975, has long been a symbol of photographic innovation. However, it has struggled to adapt to the digital age, with its decline culminating in a 2012 bankruptcy filing.

Despite efforts to diversify—such as entering industrial printing, pharmaceutical ingredient manufacturing, and film supply for cinema—the financial damage continues to mount.

** At a Glance: Kodak’s Crisis**

| Metric | Details |

|---|---|

| Debt | ~$500 million due within 12 months; insufficient liquidity to cover it. |

| Stock Drop | Shares fell 13%–25% post-announcement. |

| Cost Measures | Retirement pension payments paused. |

| Historical Context | Founded in 1892; dominated film/photography; common “Kodak moment.” |

| Past Struggles | Filed for Chapter 11 in 2012; post-bankruptcy pivot attempts ongoing. |