Japanese chipmaker Kioxia surge 540% in 2025 has become one of the most dramatic success stories in the global semiconductor industry. Once seen as a struggling memory-chip producer, Kioxia’s sharp rise this year reflects a powerful turnaround driven by booming demand for AI infrastructure, data centers, and next-generation storage solutions.

The surge has caught the attention of investors worldwide and repositioned Kioxia as a key player in the fast-changing chip market.

Japanese Chipmaker Kioxia Surge 540% in 2025 on AI-Driven Demand

The reason Japanese chipmaker Kioxia surge 540% in 2025 is closely tied to the explosive growth of artificial intelligence. As AI models grow larger and more complex, companies are racing to expand data centers that rely heavily on high-performance NAND flash memory.

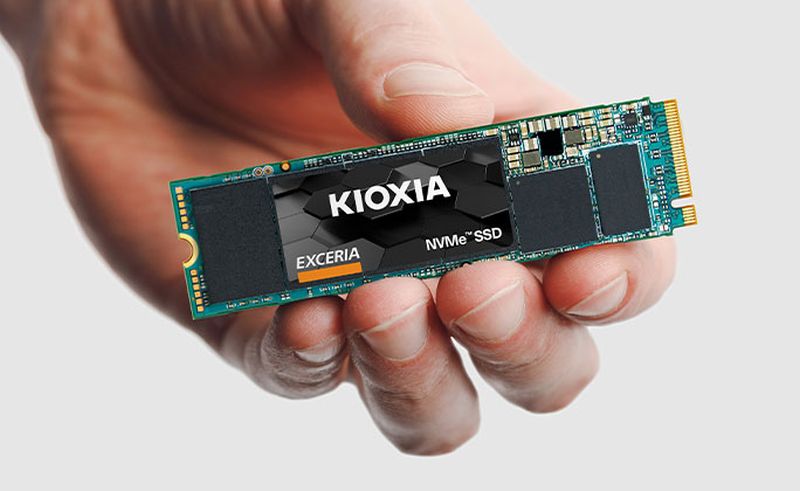

Kioxia is one of the world’s leading producers of NAND flash, a critical component used in AI servers, cloud storage, smartphones, and enterprise systems. Rising prices for memory chips and stronger long-term contracts have significantly boosted Kioxia’s revenue outlook.

From Industry Pressure to Record-Breaking Growth

Only a few years ago, Kioxia faced falling prices, weak demand, and intense competition. The fact that Japanese chipmaker Kioxia surge 540% in 2025 highlights how quickly fortunes can change in the semiconductor cycle.

As global inventories tightened and AI investments accelerated, memory-chip prices rebounded sharply. Kioxia benefited from better pricing power, improved production efficiency, and renewed customer demand from hyperscale cloud providers.

This shift transformed investor sentiment almost overnight.

Why Investors Are Betting Big on Kioxia

The story behind Japanese chipmaker Kioxia surge 540% in 2025 is not just about short-term profits. Investors see Kioxia as a long-term beneficiary of structural trends shaping the tech industry.

AI workloads require massive data storage, fast read-write speeds, and energy-efficient chips. Kioxia’s focus on advanced NAND technology places it directly at the center of this demand. Analysts believe this positioning could support strong earnings growth for years, not just months.

Japan’s Semiconductor Revival Gains Momentum

The fact that Japanese chipmaker Kioxia surge 540% in 2025 also reflects a broader revival of Japan’s semiconductor sector. After losing ground to rivals in the past, Japanese chip firms are regaining relevance through specialization in memory, materials, and manufacturing equipment.

Government support, increased capital investment, and global supply-chain diversification have all helped strengthen Japan’s chip ecosystem. Kioxia’s performance is now seen as a symbol of that comeback.

What This Means for the Global Chip Industry

When Japanese chipmaker Kioxia surge 540% in 2025, it sends a strong signal to the market that memory chips are once again strategic assets. AI, cloud computing, autonomous systems, and next-generation devices all depend on reliable and scalable storage.

Competitors are now under pressure to expand capacity, improve efficiency, and secure long-term customers, potentially setting the stage for another intense investment cycle across the industry.

Can Kioxia Sustain Its Momentum?

While Japanese chipmaker Kioxia surge 540% in 2025 is impressive, analysts warn that the semiconductor industry remains cyclical. Memory prices can fluctuate, and global demand can shift quickly.

However, many believe AI-driven storage demand represents a longer-lasting trend compared to past cycles. If Kioxia continues innovating and managing supply carefully, its growth could prove more sustainable than previous booms.

Final Thoughts

The fact that Japanese chipmaker Kioxia surge 540% in 2025 marks one of the most remarkable turnarounds in recent tech history. From industry headwinds to explosive growth, Kioxia has re-established itself as a vital force in the AI-powered future.

For investors and industry watchers alike, Kioxia’s rise is a clear reminder that in the semiconductor world, timing, technology, and demand can change everything.