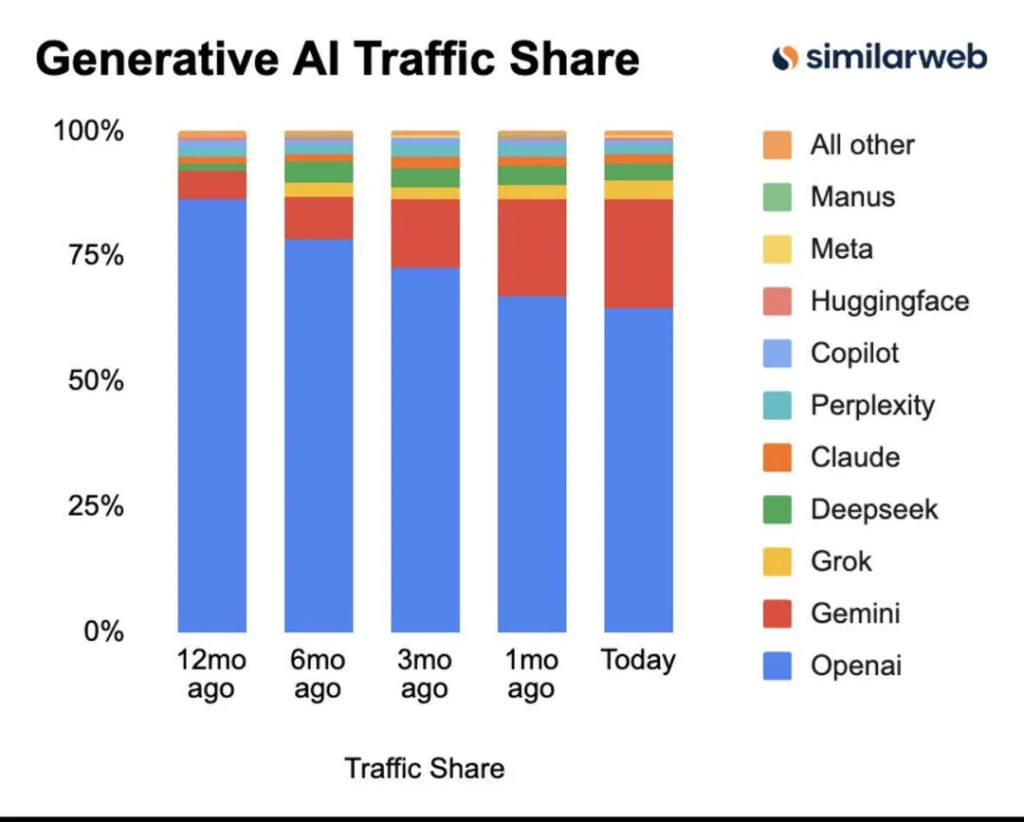

For much of 2024 and 2025, Gemini hovered between 13% and 14% share. However, the launch of Gemini 3 in late 2025, combined with aggressive ecosystem integration, triggered a 237% year-over-year growth rate—the fastest of any major AI platform.

The Factors Behind the Growth

- Search Integration: Gemini now powers “AI Overviews” and the new “AI Mode” within Google Search, reaching an estimated 2 billion users daily. This integration allows users to get AI-generated summaries without ever leaving the search results page.

- The Apple Partnership: In mid-January 2026, Apple confirmed it is paying Google an estimated $5 billion annually to power the new AI-enhanced Siri with Gemini models. This move admitted Gemini into the pockets of millions of high-value iPhone users.

- Android Dominance: As the default assistant on over 3 billion devices, Gemini has benefited from “force-multiplied” exposure, particularly in smartphone-heavy markets like India and Vietnam.

- Viral Features: The success of the “Nano Banana” image-generation model and the recently launched Veo 3 video tools have attracted a younger demographic seeking creative rather than just analytical AI.

AI Chatbot Market Share Comparison: January 2026

| Platform | Jan 2025 Share | Jan 2026 Share | Trend |

| ChatGPT (OpenAI) | 86.7% | 64.5% | ▼ |

| Google Gemini | 5.7% | 21.5% – 22.0% | ▲▲ |

| Microsoft Copilot | 12.0% | 13.4% | ▲ |

| Grok (xAI) | 0.0% | 3.4% | ▲▲ |

| Claude (Anthropic) | 3.1% | 3.5% | Stable |

The “Code Red” at OpenAI

The decline of ChatGPT from an 87% monopoly to 64% has reportedly triggered a “Code Red” at OpenAI. While ChatGPT remains the leader with 800 million weekly active users, its growth has slowed to roughly 5% quarter-over-quarter, compared to Gemini’s 44% expansion in the same period.

To combat this, OpenAI is reportedly accelerating the development of its next-generation model, codenamed “Garlic,” and testing its first in-chat advertisements to sustain its $14 billion annual burn rate.

A Fragmented 2026 Landscape

The market is no longer a two-horse race. Specialized players are successfully carving out niches:

- Perplexity: Maintaining its lead in “AI Search” for academic and professional use.

- DeepSeek: Gaining massive traction in developing nations with high-efficiency local models.

- Grok: Leveraging the real-time data from X (formerly Twitter) to capture the “news-focused” AI segment.

Conclusion: Distribution is King

The 2026 data proves that in the AI wars, distribution beats first-mover advantage. By embedding Gemini into the operating systems and search habits of billions, Google has neutralized OpenAI’s early lead. As we head into the spring of 2026, the industry is no longer asking if a “Google alternative” exists, but rather how much further the Google ecosystem can expand.