Bitcoin’s illiquid supply has surged to a record 14.3 million BTC, representing over 72% of the cryptocurrency’s circulating supply of approximately 19.9 million BTC, as reported by Glassnode on September 20, 2025. This milestone highlights growing confidence among long-term holders and institutions, reducing available supply on exchanges and potentially fueling price appreciation. In this article, we explore the details of this development, its implications for Bitcoin’s price, and what it signals for the broader crypto market. NewsBTC,

Bitcoin’s Illiquid Supply Milestone: Key Details

Illiquid supply refers to Bitcoin held by entities unlikely to sell, such as long-term investors, cold storage wallets, and public companies with minimal transaction history. Key facts from recent data include:

- Record High: 14.3 million BTC, up 20,000 BTC in the last 30 days, despite a 15% price correction from August’s $124,000 peak.

- Percentage Breakdown: Over 72% of circulating supply is now illiquid, leaving only about 5.6 million BTC as liquid (available for trading).

- Holder Cohorts: Includes Bitcoin unmoved for 7+ years and public companies holding 1,000+ BTC, with MicroStrategy leading at 638,985 BTC (3% of total supply).

- Exchange Outflows: Continued decline in BTC on exchanges, with historic lows, further tightening liquidity.

Fidelity projects long-term holders and corporations could control over 6 million BTC (28% of total supply) by year-end.

What Illiquid Supply Means for Bitcoin’s Price

A high illiquid supply indicates reduced selling pressure, often a bullish signal:

- Supply Shock Potential: With demand rising (e.g., ETF inflows), limited liquid supply could drive prices higher, as seen in past cycles.

- Holder Confidence: Despite volatility, accumulation by whales and institutions (up 30% in corporate holdings to 2.88 million BTC) shows long-term faith.

- Historical Context: Illiquid supply has decreased only once quarter-over-quarter since inception, correlating with price rallies.

- Risks: Potential capitulation, as 80,000 “ancient” BTC (unmoved 10+ years) sold in July 2025, could trigger short-term dips.

Analysts like Arthur Hayes call it the “most bullish signal,” predicting upward pressure.

Implications for the Crypto Market

The 72% illiquid supply milestone has broader effects:

- Bullish Sentiment: Reinforces Bitcoin as a store of value, with market dominance at 57.71% and trading volume up 18.54% to $28.17 billion daily.

- Institutional Adoption: Corporate treasuries (e.g., MicroStrategy) and ETFs lock up supply, potentially amplifying price moves.

- Exchange Dynamics: Lower BTC on exchanges reduces liquidity risks but could heighten volatility during demand spikes.

- Global Context: Aligns with trends like India’s #1 crypto adoption ranking and Ethereum’s $1B daily stablecoin influx, signaling maturing markets.

The Bigger Picture: Bitcoin’s Maturation

Bitcoin’s illiquid supply surge reflects its evolution from speculative asset to institutional store of value, amid 2025’s bull run (price at $111,687, up 4.52% monthly). With 19.92 million BTC circulating (95% of max 21 million), scarcity intensifies. This parallels global shifts like xAI’s $10B raise and Oracle’s $20B Meta deal, where limited resources drive value.

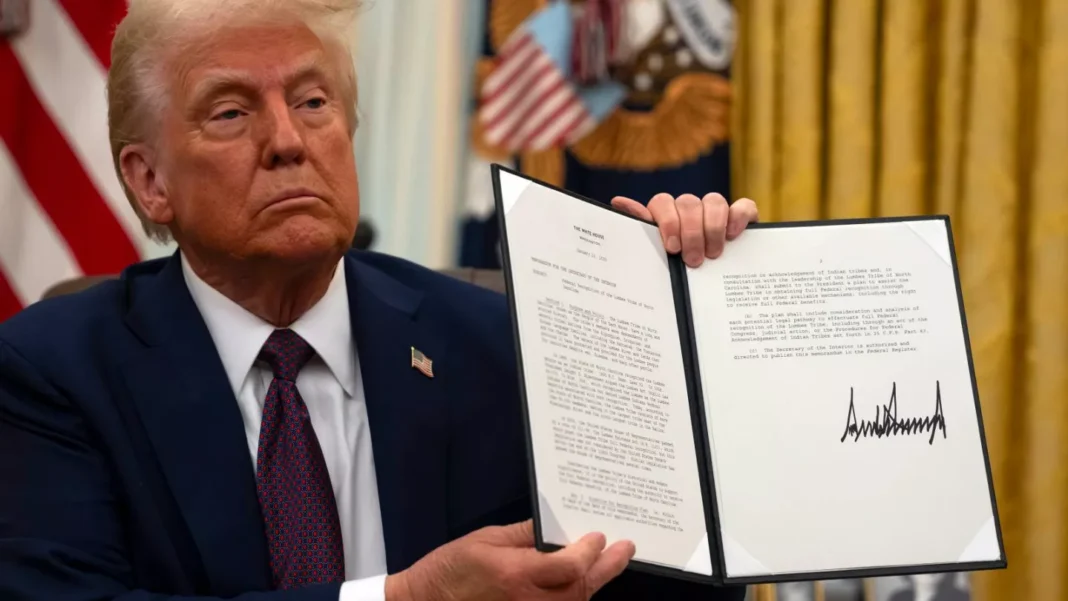

However, risks like whale movements or regulatory pressures (e.g., Trump’s H-1B fees impacting tech/crypto talent) persist.

What’s Next for Bitcoin’s Supply Dynamics?

Key developments to monitor:

- Q4 2025 corporate/ETF holdings, targeting Fidelity’s 6M BTC projection.

- Exchange inflows during price corrections for capitulation signals.

- Impact of Bitcoin’s market dominance (57.71%) on altcoins.

- Regulatory responses to illiquidity, potentially affecting trading platforms.

Conclusion

Bitcoin’s illiquid supply reaching 72% of circulating supply in September 2025 is a resounding bullish indicator, underscoring holder conviction and supply scarcity. As long-term accumulation persists despite volatility, this milestone could propel BTC toward new highs, reinforcing its role as digital gold. With institutional interest mounting, the market’s future looks increasingly constrained—and upward.