In one of India’s largest consolidated real estate transfers, Adani Properties Pvt. Ltd.—the real estate arm of the Adani Group—has agreed to acquire more than 88 properties from the beleaguered Sahara Group, including marquee assets like the sprawling Aamby Valley City township and the Sahara Star hotel. Sahara submitted a term sheet to the Supreme Court on September 6, 2025, proposing this single-block sale to expedite refunds to millions of investors defrauded in a ₹24,000 crore SEBI scam, with proceeds directed to the SEBI-Sahara Refund Account. Valued at thousands of crores (exact figure sealed for court), the deal—pending judicial approval—marks a strategic masterstroke for Adani, bolstering its real estate portfolio amid India’s booming property market, while offering Sahara a swift exit from prolonged legal entanglements.

For investors eyeing Adani’s expansion, real estate watchers, and those following the Sahara saga, this acquisition could unlock billions in value, shield assets from probes, and accelerate investor payouts. Let’s unpack the assets, deal mechanics, and broader implications.

The Portfolio: 88+ Prime Assets Across India

The proposed sale encompasses a diverse, high-value trove of Sahara’s remaining holdings, consolidated into one lump-sum transaction to maximize returns and minimize delays. This bulk approach avoids the pitfalls of piecemeal sales, which Sahara deemed too time-consuming amid regulatory hurdles.

Key highlights of the portfolio:

| Asset Category | Notable Properties | Location/Details | Strategic Value for Adani |

|---|---|---|---|

| Townships & Residential | Aamby Valley City (8,810 acres) | Lonavala, Maharashtra; luxury gated community | Prime redevelopment for ultra-luxury housing/hotels. |

| Hospitality | Sahara Star Hotel (170 acres) | Mumbai Airport vicinity; 5-star property | Enhances Adani’s aviation-adjacent hospitality footprint. |

| Commercial/Urban Developments | Sahara City, various land parcels | Lucknow, UP; plus sites in Haryana, Rajasthan, Gujarat, West Bengal, Jharkhand, MP, Karnataka, Uttarakhand | Expands urban mixed-use projects in Tier-1/2 cities. |

| Total Properties | 88+ (land, buildings, developments) | Nationwide; high-value, disputed assets | Diversifies Adani’s ₹50,000+ crore realty pipeline. |

These assets, once Sahara’s crown jewels, have been frozen or probed since the 2012 SEBI order, stalling sales and refunds. Post-founder Subrata Roy’s 2023 death, Sahara accelerated liquidation, having already deposited ₹16,000 crore from prior sales.

Deal Mechanics: Supreme Court Oversight and Investor Safeguards

Sahara’s petition invokes Article 142 for “complete justice,” seeking court powers to:

- Approve the Sale: As a single entity to Adani, with payment deposited into the SEBI-Sahara Refund Account or court-directed escrow.

- Exempt Assets: From all ongoing/future inquiries, investigations, or attachments by SEBI, tax authorities, or enforcement agencies.

- Form Oversight Committee: Led by a former Supreme Court judge to handle disputes, liabilities, and transitions.

This structure ensures refunds to 4.7 crore investors (many small savers) while granting Adani clean title. The term sheet’s financials remain confidential, sealed for the court, but sources peg the portfolio at “thousands of crores.”

Why Now? Sahara’s Exit Strategy Meets Adani’s Expansion

Sahara’s move stems from a decade of litigation: The 2012 SEBI probe into optionally fully convertible debentures (OFCDs) led to a ₹24,000 crore refund mandate, with only partial compliance. Individual sales dragged due to probes and market woes; a bulk deal to Adani—post its Dharavi win and Radius Estates buy—offers speed and value.

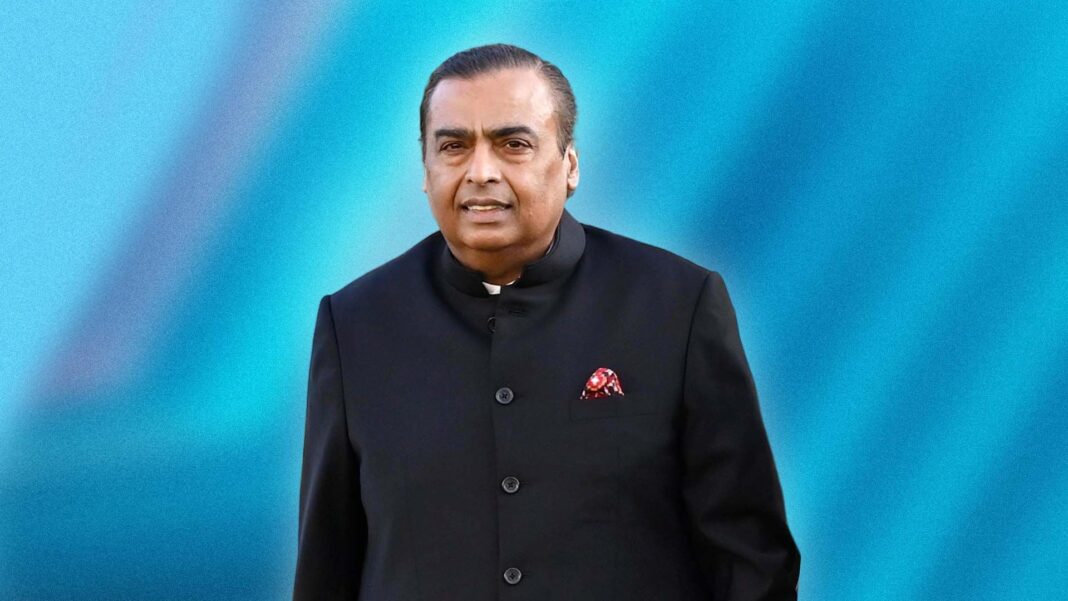

For Adani, it’s accretive: Builds on its ₹5,069 crore Dharavi bid (2022) and $9M Radius acquisition (2023), targeting India’s $200B realty surge. Gautam Adani’s empire, valued at $100B+, eyes hospitality and urban redevelopment synergies.

Implications: Wins for Investors, Boost for Adani Realty

- Investor Relief: Speeds ₹24,000 crore refunds, closing a chapter for millions affected since 2012.

- Adani’s Growth: Adds premium inventory, potentially yielding 20-30% ROI via redevelopment; enhances portfolio post-Jio-Star merger.

- Sector Ripple: Signals court-enabled resolutions for legacy disputes, boosting M&A in realty; Adani shares up 1-2% on news.

Risks: Court delays or probe exemptions could stall; Sahara’s liabilities (e.g., ₹16,000 crore deposited) add scrutiny.

Conclusion: Adani’s Sahara Swoop – A Mega Real Estate Pivot

The Adani Group’s prospective acquisition of Sahara’s 88+ properties is a game-changer, blending distressed asset revival with strategic expansion while unlocking refunds for defrauded investors. Pending Supreme Court greenlight, it could redefine India’s realty landscape, turning Sahara’s woes into Adani’s windfall. As filings progress, expect valuation reveals and market buzz. india.com